初日のワークショップはVC 2.0というセッションに参加。

VC 2.0の概要は

VC 2.0: An Entrepreneur's Market? をご覧ください。

Participants:

Fred Wilson, Union

Square Ventures

Paul Graham,

Partner, Y Combinator

Steve Jurvetson,

Managing Director, Draper Fisher Jurvetson

Ross Mayfield,

CEO, Social Text

Ross Mayfield のブログはこちら

議事録のようなブログがありますのでご紹介します。

(Web 2.0 Conference - VC 2.0 - An Entrepreneur's market から引用)

I'm sitting on this panel because it really does seem

like there's a new buzz going around...

Steve - enterpreneurs are in the drivers seat now. We are out of the doom and

gloom period. We are Into the period of hope, optimism and greed.

Fred - cost of building consumer internet apps has dropped. This is an

opportunity here.

Ross - The best time to start is in a bust. Started company with $5k. Put

in 6 months worth of sweat equity. Iterated with customers quickly. Had to make

the effort to make sure that things . Took a $150k round from social networking

folks like Mark Pincus. Took 600k total.

Fred - is there a business for VCs anymore with the dropping costs

Paul - Yes you can start a company on a lot less money than you could before.

You seem smart, you have a reasonable idea we'll try it out. Willing to make

bets around 10k range. Living expenses of grad students. If you have low living

expenses you have a huge advantage.

Fred - do traditional VCs go later?

Steve - there are different things going on now. Model in web services lowers

the costs of partnerships. Things are much more flexible than before. Sales

model is very different. Software is bought not sold. Easier than ever to get

products to market Angels having a heyday.

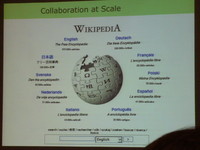

Ross - Web 2.0 is not webservices. Web 2.0 is buliding the social

infrastructure. Cultural shift happening among net generation.

Fred - What's really new here?

Ross - Always have a bottom up start demand pattern. Too expensive to sell to

the CIO first.

Fred - Is there anything special about Web 2.0 that changes your

investing?

Paul - I've never believed the Web 2.0 definiton. Ended up investing all in

consumer web applicatoins because that's what we understand and is hot. Corrupt

relationship in Enterprise sales now. Do the endrun. Consultants can

sell/install stuff at ridiculous prices. IT departments are ripe for the

killing.

Fred - (to Paul) - you are making small capital bets you could make a lot of

bets. There's a space between Angels and traditional VCs. Money corrupts.

Ross - Enterprise software companies used to cost $40M to be fully

capitalized. $4M today.

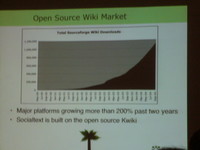

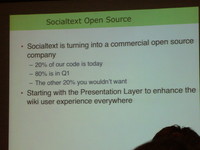

Fred - Is Open Source a central aspect of what is happening?

Ross - Yes. There's a cultural choice about what tools to use.

Fred & Steve - both talked about how if there's open source in a

company then MSFT and Oracle won't acquire it. IBM Will

Question - I asked, how does Web 2.0 change the VC equation? Are you looking

for different things? Are you willing to make smaller bets?

Paul - I only

make small investments.

Fred - Avg investment < $2M. How do we manage such

small bets? No great answer to that. Ultimately looking for people but can't

Steve - Yes. Engage network effects. Self re-inforcing. Need the community

to participate.

Fred - Problem with the IPO is that there's a huge growth

after the IPO. As a VC there's not really a difference in sale vs. IPO.

Question - Does taking VC mean that my users will revolt?

Ross - it's a

community management issue. You need to set up the social contract with the

community.

Question - If I don't need the money should I take it for

endorsement?

Fred - You should never take the money don't take the

money.Google took it because they had to. Endoresement value is worthless. Only

two things that matter . Cash + people who will help you and not hurt you.

Question - Why are the VCs important at all? Justify your role.

Paul - The

connections matter. They open the door for you. Board member contacts are

valuable.

Question - What's the value of technology vs. community?

Steve - We value

community more than technology. Some industries are different like Pharma.

Question - Many entrepreneurs are saying I don't want money or much smaller

amounts of money. Maybe 10-20% get early stage funding. Not enough angels around

to feed the need. Almost seems like there needs to be an incubator fund.

Paul

- That's exactly what I do. You need something mroe organized

than angels.

Ross - Maybe VCs can invest individually instead of in a large

fund.

Fred - It's been done. 3 VCs came in and started a small venture

fund.

(Web 2.0: VC2 2.0 Panel から引用)

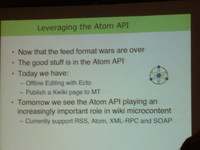

The panel then talks about how Web 2.0 has changed VC investment

strategies, and the amount of capital invested. Paul Graham states that

he looks at the tools used by the prospective investment (Ruby vs.

Java, etc.) – which is a very strange statement to be honest –

basically use the most appropriate, efficient and scalable toolset.

Fred reckons that they will tend to invest smaller amounts because of

reduced capital requirements. For Ross, Web 1.0 was about Commerce, Web

2.0 is about people and the fact that these new tools are putting them

back in the driving seat. For Steve, Web 2.0 and Open source drive huge

economies of scale thanks to network effects: he mentions SugarCRM and

the fact they now support over 20 languages thanks to the community

(which is after one year more than Salesforce.com in 8 years).

Q: Exit is M&A and not IPO, because of the limited appetite of the public market and Sarbanes Oxley issues

A:

Steve makes the point that IPOs will only make sense for the top

winners in VC portfolios, where returns will be spectacular. It should

be targeted as a goal, being open to listen to the right “take-out”

opportunities as they come.

Q: How to avoid a backfiring from one’s community when taking VC

investment or being acquired. Quote the MySpace acquisition a bad news

for its community.

A: Ross states that the issue is community management, and the social contract that has been signed with the community.

Q: Why should a company take VC money if they are already cash flow positive ? Isn’t a VC investment becoming an endorsement ?

A: If you don’t need the money, then don’t bother with VCs

(Fred Wilson: “If you don’t need money, and you take it, you should be

shot”). And the endorsement value can only be leveraged in the context

of relationships and contacts VCs can open.

A: Fred mentions another type of deals where VC (or private equity) funds buy out a portion of founders equity.

Q: What is most valuable: technology, community, business model ?

A: Steve explains that clearly the value is in the network and the (geometric) pattern of growth of one’s community.

Q: What is the expected desktop platform, 5 years out (vs. today’s dominance of Microsoft) ?

A:

Weblogs and wikis will be used widely across businesses, and these

tools don’t need Windows. Ross sees applications contributing to the

social fabric as a driver for diversity.

Q: There is a gap between Angels investing and VCs that is growing

because of limited requirements of Web 20 companies. This has created a

need for an incubator/early stage fund that VC firms could contribute

to ?

A: Ross suggests that one of the ways would be to allow VC

partners to invest their personal capital. Fred mentions that an early

stage VC fund has been created for that purposed. Steve explains that

there are limitations due to their own limited partnership agreements

(and the need to avoid Double fee, Double carry).

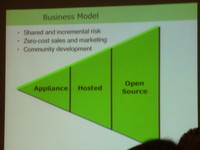

Q: How can Web 2.0 companies make money without having millions of users (in the case of an infrastructure company) ?

A:

Generate value at all levels of usage (Ross mentions wikis delivering

values to 2 people to large teams to very large communities).

論点としてはいくつかあるのですが、

①コストの低減&開発スピードアップ と 資金調達額の減少

オープンソースを活用し、そして開発もコミュニティーで行っていくと、開発コストが下がり、スピードも上がるというものです。 そうなると、VCから資金調達する金額も少なくてよい というのが一つ。

”Enterprise software companies used to cost $40M to be fully

capitalized. $4M today.” と Ross が言っているように コストは10分の1になった。

また、Steveは以下のようなコメントをしている。

”Web 2.0 and Open source drive huge

economies of scale thanks to network effects: he mentions SugarCRM and

the fact they now support over 20 languages thanks to the community

(which is after one year more than Salesforce.com in 8 years).” スピードアップ ということです。

シリコンバレー型というのは、スタートアップから、思い切りガソリン積んで、アクセル踏みましょう というのが一般的だったのですが、 Web 2.0 では違うのだ ということです。

日本の場合でも同様です。GREE,はてな、イーマーキュリー、フォートラベルさんといったところはオープンソースを活用しています。コンテンツもユーザーが参加して作るモデルです。 私はGREEに経営参加している立場として、いろいろと発言する機会が多いのですが、まさにこのポイントは非常に重要なポイントです。

②IPOかM&Aか?

Web 2. 0 企業は、①のポイントであるようにコストが10分の1といった劇的にコストストラクチャーがかわります。 ユーザーには無料で提供したり、エンタープライズ向けにも低価格で提供するというモデルになります。 生きていくためには、今までの10分の1になるわけであり、売上の規模や成長性 といったところで、IPOに向かないのでは? という質問です。実際にMy Space が買収されたり、フリッカーが買収されたり、Web 2.0の企業のEXITはM&Aとなっています。

Steve も以下のようにコメントします。

”Steve makes the point that IPOs will only make sense for the top

winners in VC portfolios, where returns will be spectacular. It should

be targeted as a goal, being open to listen to the right “take-out”

opportunities as they come.”

日本の場合は、IPOのハードルがUSと異なります。規模としてはたとえば、売上高が10分の1 くらいでも上場できます。 ”spectacular" とありますが、日本の場合はチャンスは大きいと思います。

Web 2.0 のIPOの成功事例は日本から生まれる と そう感じました。 コストが10分の1、売上も10分の1だが、 IPOのハードルの10分の1 というのが理由です。

③VCは必要か?

お金もそんな必要ないので、エンジェル投資家でもいいし、VCファンドではなく、VCのパートナーが個人でお金を出すのがよい というのがRossの意見があります(Steveが言っているように利害相反になるので、個人でお金を投じることはできないのですが・・)。

結局、お金が必要のない時代は、起業家有利の時代だ というのが、セッションのタイトルであり、起業家をHelpできる人(People)だったり、社外取締役のネットワークが価値がある というでした。

Question - If I don't need the money should I take it for

endorsement?

Fred - You should never take the money don't take the

money.Google took it because they had to. Endoresement value is worthless. Only

two things that matter . Cash + people who will help you and not hurt you.

Question - Why are the VCs important at all? Justify your role.

Paul - The

connections matter. They open the door for you. Board member contacts are

valuable.

④コミュニティーの価値は?

Steve(有名VCのDFJのパートナー)は、テクノロジーより価値がある ということを言っています。 Social Text のCEOも Web 2.0 はPeopleが作るんだ! と叫んでいたように、 Web 2.0時代の価値の源泉は、人であり、そのコミュニティーなのだ。テクノロジーはオープンソースですし、オープンなビジネスモデルなので、いろいろな人が作り出すもののコラボレーションの結果が価値となってきます。

ユーザーであったり、従業員であったり、作りあがる価値はPriceless。 逆に値段も付けにくい ということなのだと思います。

GREEでも既に上記のことは理解しており、違和感なく聞いていました。 私も英語が堪能だったらそれなりに話せたのになーと思い、もっと勉強しようと思いました。

最後に

”how Web 2.0 has changed VC investment

strategies, and the amount of capital invested”

ということなのですが、私はGREEモデル と はてな モデル というのが存在するなと思います。 GREEモデルというのは、会員数で10万人になったが、従業員は数名(3-5名)となり、 そこかガソリン積んで走る というパターン。そのガゾリンも1億円程度で十分。 ネットバブル時代の10-20億円という時代は終わった。

はてな モデル というは経営陣やエンジェルといった投資家でひたすら、自社のコミュニティーのValue を高めることに専念です。

今回のVC 2.0 セッションでは、GREE型というのはSocial Text 社です。 エンジェルだけで十分だよ という意見もありました。

今後、どうなるかはわかりませんが、 私なりにいろいろと考えていきたいと思っています。